Maximizing Banking Automation ROI: A Strategic Framework Using PrimeOne™

Lessons from an 81.8% Portfolio ROI Process Transformation Initiative

Executive White Paper

Strategic Process Automation in Financial Services

Executive Summary

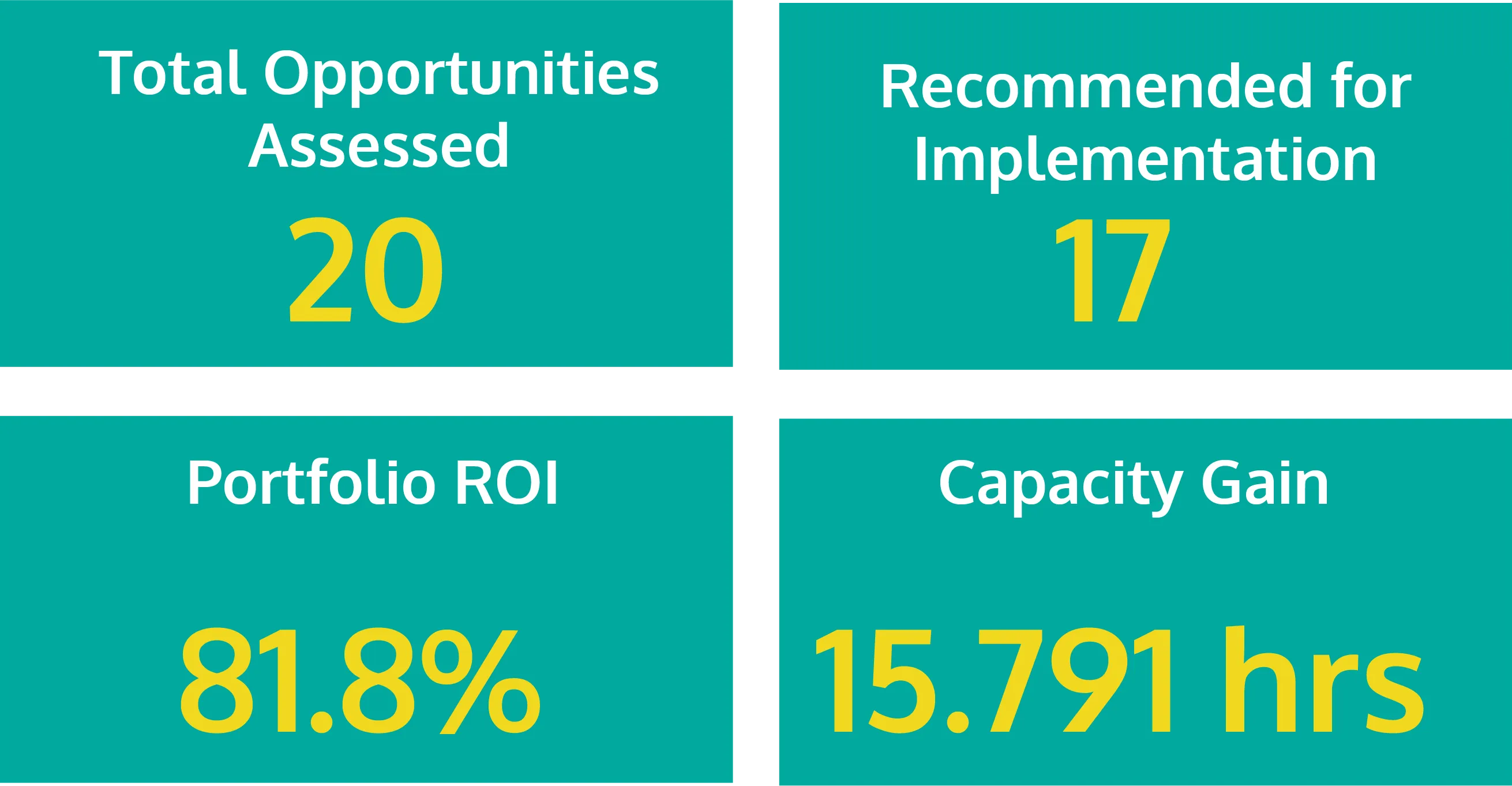

The financial services industry stands at an inflection point where process automation has evolved from an operational efficiency tool to a strategic competitive advantage. Recent analysis of a mid-sized banking automation initiative utilizing PrimeOne™'s discovery-as-a-service platform demonstrates the transformative potential of strategic process automation, achieving an 81.8% portfolio return on investment across a comprehensive assessment of 20 critical banking processes.

This white paper examines the methodology, results, and strategic insights from a comprehensive banking automation assessment conducted entirely within PrimeOne™, generating $1,169,464 in net returns over three years on an investment of $1,429,360. The findings reveal that successful banking automation requires a fundamental shift from tactical process fixes to strategic portfolio management, with PrimeOne™ serving as the enabling analytical discovery and prioritization platform that identifies high-value opportunities while protecting institutions from low-return implementations.

Key Findings:

- Strategic portfolio assessment identifies 20 opportunities with PrimeOne™, flagging three for optimization to protect implementation resources.

- Recommended implementation portfolio of 17 opportunities delivers enhanced ROI through disciplined prioritization.

- Discovery-driven approach produces $964,863 in annual economic benefits across deposit operations, mortgage, and consumer servicing functions

- Capacity gain of 15,791 annual hours (8.64 FTEs) enables workforce redeployment to strategic initiatives.

- Portfolio-based prioritization produces a healthy distribution: 40% "Excellent" or "Strong Justification," 15% requiring optimization.

- An average benefit-cost ratio of 2.22 and a 1.5-year portfolio-level payback demonstrate sustainable automation economics.

- PrimeOne™'s integrated discovery capabilities enable enterprise-wide visibility and governance of the automation pipeline.

The Banking Automation Imperative

Industry Transformation Drivers

Financial institutions face unprecedented pressure to reduce operational costs, improve customer experience, and maintain regulatory compliance while competing with fintech disruptors. Traditional approaches to operational efficiency, workforce optimization, process reengineering, and technology upgrades have reached their effectiveness limits.

Process automation represents the next frontier of operational excellence, but success requires moving beyond simple task automation to strategic process transformation. The difference lies not in the technology deployed but in the methodology used to identify, analyze, prioritize, and implement automation initiatives.

The PrimeOne Advantage

The PrimeOne™ Advantage lies in its ability to transform fragmented, siloed automation initiatives into a strategic, ROI-driven program purpose-built for enterprise financial services environments.

Here’s how PrimeOne stands apart:

Discovery-as-a-Service Built for ROI

Unlike traditional tools that capture automation ideas, PrimeOne™ combines process discovery with strategic evaluation, enabling banks to:

- Identify high-impact, low-complexity automation candidates

- Score opportunities based on volume, manual effort, and business rules

- Model expected ROI and payback periods before development begins

- Generate comprehensive benefit-cost analyses with sensitivity modeling

- Flag marginal opportunities before committing implementation resources

Centralized Intake & Governance

PrimeOne™ replaces spreadsheet-based intake with a centralized, digital pipeline that:

- Captures, validates, and prioritizes automation requests across business units

- Tracks implementation progress and post-deployment performance

- Supports portfolio-level oversight, ensuring scalability and alignment with enterprise goals

- Maintains complete traceability from opportunity identification through value realization

- Protects portfolio ROI through transparent risk assessment

Actionable Analytics for Stakeholders

PrimeOne™ provides comprehensive visibility for business, IT, and executive teams with

- Real-time dashboards showing automation value across the portfolio

- Metrics tied to cost savings, cycle time reduction, FTE impact, and ROI performance

- Strategic insights to support scaling, resourcing, and reinvestment decisions

- BCR-based prioritization frameworks that align automation investments with strategic objectives

- Clear identification of opportunities requiring redesign or optimization

Closed-Loop Automation Lifecycle

From idea intake to post-deployment ROI tracking, PrimeOne™ enables end-to-end automation lifecycle management that ensures sustained value delivery and continuous portfolio optimization.

Methodology: Strategic Process Portfolio Assessment

Discovery Framework

The success of any banking automation initiative begins with rigorous process assessment. The methodology employed in this study demonstrates the importance of comprehensive discovery over piecemeal automation attempts.

Assessment Dimensions:

- Transaction Volume Analysis: Quantifying daily/annual processing volumes to identify scale opportunities

- Manual Processing Time Evaluation: Documenting current time requirements per transaction and annual effort

- Resource Utilization Mapping: Calculating FTE impact based on salary rates and total hours saved

- Capacity Gain Analysis: Measuring hours freed for redeployment to higher-value strategic activities

- Error Reduction Potential: Assessing quality improvement opportunities and compliance risk mitigation

- Financial Impact Modeling: Calculating three-year benefits, costs, net returns, and ROI projections

- Risk Assessment: Identifying opportunities requiring optimization or redesign before implementation

PrimeOne™ Assessment Capabilities

PrimeOne™'s integrated assessment framework provides structured methodologies for process evaluation and prioritization:

- BCR Calculation Engine: Sophisticated benefit-cost ratio modeling with automated interpretation categories

- Portfolio Analytics: Comprehensive evaluation across multiple dimensions, enabling strategic comparison

- Capacity Planning Tools: Analysis of workforce redeployment opportunities and strategic capacity gains

- Implementation Planning: Automated timeline estimation and resource requirement forecasting

- Risk Assessment Matrix: Identification of opportunities requiring optimization or redesign

- Multi-Year Financial Modeling: Multiple-year benefit projections with cost amortization and payback analysis

- Transparent Prioritization: Clear flagging of marginal opportunities to protect implementation resources

All discovery activities, from initial opportunity capture to detailed financial modeling and risk assessment, were conducted within PrimeOne™'s unified platform—eliminating the need for disconnected tools or manual consolidation efforts.

Case Study Results: Portfolio Performance Analysis

Full Pipeline Assessment vs. Recommended Implementation Portfolio

PrimeOne™'s comprehensive discovery process evaluated all automation opportunities across identified business units, providing complete transparency into both high-performing candidates and opportunities requiring optimization. This two-tiered view demonstrates the platform's strategic value in protecting implementation resources while maximizing portfolio returns.

Full Pipeline Assessment:

- Total Opportunities Assessed: 20 processes

- Business Units Covered: Deposit Operations, Deposit Services, Consumer Servicing, Mortgage, Bankcard Services

- Total Annual Manual Effort: 15,791 hours

- Annual Capacity Gain: 15,791 hours available for strategic redeployment

- FTE Impact: 8.64 FTE equivalents

- Workforce Capacity Freed: 8.64 FTEs available for higher-value initiatives

- Total Annual Economic Benefit: $964,863

- Total 3-Year Benefits: $2,598,824

- Total Automation Cost: $1,429,360

- Total 3-Year Net Benefit: $1,169,464

- 3-Year Portfolio ROI: 81.8%

- Average 3-Year ROI (All Opportunities): 107.5%

- Median 3-Year ROI: 52.0%

- Average Benefit-Cost Ratio: 2.22

- Portfolio-Level Simple Payback: 1.5 years

Recommended Implementation Portfolio:

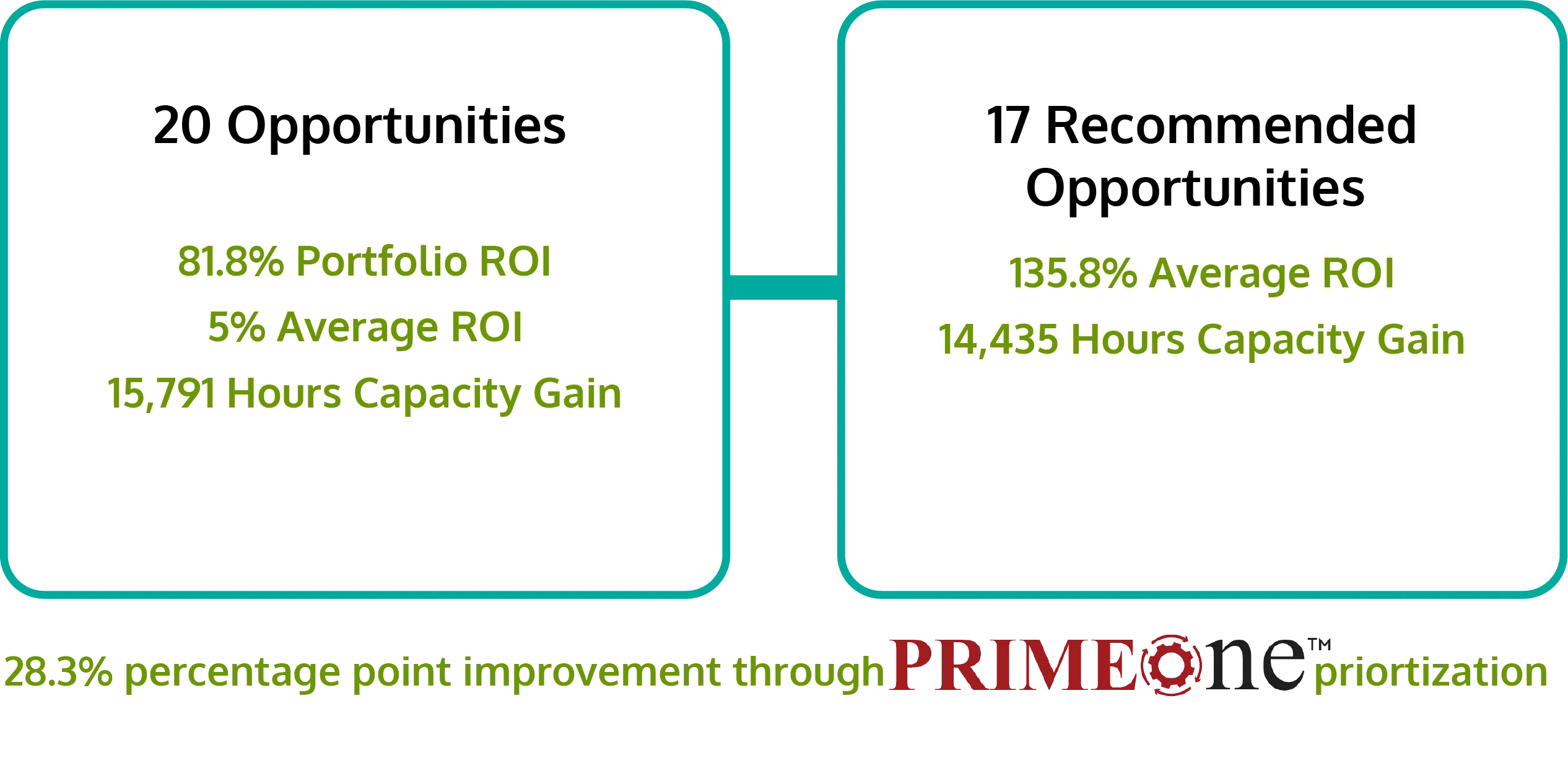

PrimeOne™'s assessment identified three opportunities requiring redesign or optimization, protecting implementation resources and enhancing overall portfolio performance:

- Opportunities Recommended: 17 processes (85% of pipeline)

- Opportunities Flagged for Optimization: 3 processes (15% of pipeline)

- Average 3-Year ROI (Recommended Only): 135.8%

- ROI Improvement Through Prioritization: +28.3 percentage points

- Implementation Cost Protected: Estimated $168,000 in automation costs avoided on marginal opportunities.

- Capacity Gain (Recommended Portfolio): 14,435 hours annually from high-confidence opportunities

- Strategic Value: PrimeOne™'s risk assessment prevented deployment of negative-return automations, protecting portfolio economics

By removing the three lowest performing opportunities, the average ROI per opportunity improves by 28.3 percentage points. This graphic shows that:

- The three flagged opportunities were dragging down the average

- The 17 recommended opportunities have stronger individual performance

- PrimeOne™'s prioritization identifies the higher-quality opportunities

The Strategic Value of Comprehensive Assessment

This case study demonstrates a fundamental principle of successful automation programs: comprehensive assessment creates value by identifying what NOT to automate, not just what to automate.

PrimeOne™'s Risk Management Impact:

- Pre-Implementation Identification: Three marginal opportunities flagged before the implementation of the resource commitment

- Cost Avoidance: Protected approximately $168,000 in automation costs that would have generated minimal or negative returns

- Portfolio Protection: Maintained 81.8% overall portfolio ROI by preventing value-destroying

- Strategic Learning: Flagged opportunities inform automation design standards and minimum viability thresholds

Comparison Scenario:

Without PrimeOne™'s risk assessment, implementing all 20 opportunities would have:

- Consumed additional implementation resources on marginal processes

- Reduced overall portfolio performance through negative-return automations

- Created organizational skepticism about the automation program's effectiveness

- Diverted resources from high-performing opportunities

With PrimeOne™'s transparent assessment:

- 17 high-confidence opportunities advance to implementation

- 3 opportunities return to the process improvement phase for optimization

- Portfolio economics protected through disciplined prioritization

- Implementation resources focused on proven value creators

The waterfall chart illustrates how strategic prioritization safeguards and enhances portfolio value. Beginning with the ROI of all 20 automation opportunities (81.8%), the analysis removes three marginal, low-impact initiatives that would have diluted overall returns. This adjustment results in a substantial improvement, elevating the portfolio ROI to 135.8% across the recommended 17 opportunities. The visual demonstrates how PrimeOne™ prioritization not only drives higher returns but also protects the organization from investing in low-value automation efforts, ultimately ensuring that resources focus on opportunities with the most significant impact.

Overall Portfolio Metrics

The comprehensive banking automation initiative, conducted entirely within PrimeOne™, identified and assessed 20 distinct automation opportunities across five business units, revealing significant variation in automation potential and strategic value:

Portfolio Summary:

- Total Opportunities Assessed: 20 processes

- Business Units Covered: Deposit Operations, Deposit Services, Consumer Servicing, Mortgage, Bankcard Services

- Total Annual Manual Effort: 15,791 hours

- Annual Capacity Gain: 15,791 hours freed for strategic redeployment

- Percentage of Annual Work Hours: Equivalent to 8.64 full-time positions

- FTE Impact: 8.64 FTE equivalents

- Workforce Capacity Freed: 8.64 FTEs available for higher-value initiatives

- Total Annual Economic Benefit: $964,863

- Total 3-Year Benefits: $2,598,824

- Total Automation Cost: $1,429,360

- Total 3-Year Net Benefit: $1,169,464

- 3-Year Portfolio ROI: 81.8%

- Average Benefit-Cost Ratio: 2.22

- Median Benefit-Cost Ratio: 1.52

- Portfolio-Level Simple Payback: 1.5 years

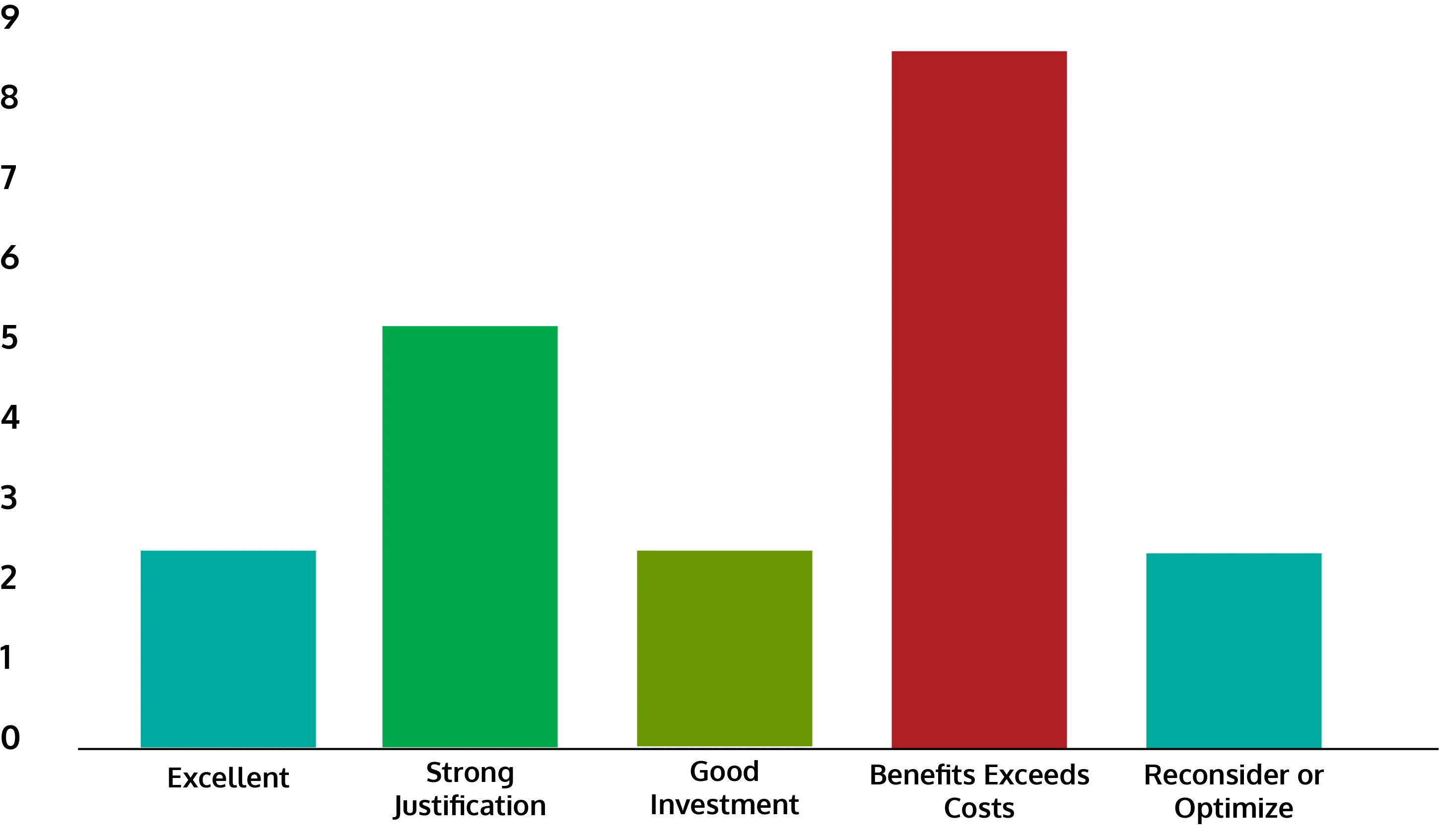

BCR Distribution and Portfolio Health

Benefit-Cost Profile:

- Average 3-Year ROI (All 20 Opportunities): 107.5%

- Average 3-Year ROI (17 Recommended): 135.8%

- Median 3-Year ROI: 52.0%

BCR Interpretation Mix:

- Excellent: 2 opportunities (10%)

- Strong Justification: 5 opportunities (25%)

- Good Investment: 2 opportunities (10%)

- Benefits Exceed Costs: 8 opportunities (40%)

- Reconsider or Optimize: 3 opportunities (15%)

This distribution illustrates a healthy pipeline: the majority of candidates (75%) deliver solid or strong justification, while a smaller subset (15%) is explicitly flagged for redesign or further optimization. Rather than being discarded, these "Reconsider or Optimize" items serve as strategic probes that sharpen portfolio governance and help refine automation design standards.

The Strategic Insight: PrimeOne™'s transparent assessment methodology ensures marginal opportunities are explicitly identified and managed, protecting portfolio ROI while creating learning opportunities that inform future automation design. The 17 recommended opportunities represent high-confidence implementations with an average ROI of 135.8%—demonstrating how disciplined prioritization enhances portfolio performance.

The BCR distribution highlights that the majority of automation opportunities demonstrate strong financial justification. Most fall into the "Benefits Exceed Costs" category, with eight opportunities showing a solid return on investment relative to the required investment. An additional five opportunities are classified as "Strong Justification," reinforcing their value and alignment with business priorities. Only a small number (3) "Reconsider or Optimize" and two each in "Excellent" and "Good Investment" require further review or refinement. Overall, the distribution confirms a healthy pipeline with most opportunities delivering clear, favorable benefit-cost performance.

Strategic Value of "Reconsider" Category:

These three opportunities collectively represent approximately $168,000 in automation costs that PrimeOne™'s assessment protected by identifying marginal economics before implementation began. Rather than destroying value, these opportunities serve multiple strategic purposes:

- Portfolio Guardrails: Establish minimum viability thresholds for future opportunity assessment

- Design Standards: Inform automation architecture and implementation approach refinement

- Stakeholder Confidence: Demonstrate the platform's analytical rigor and transparent risk management

- Resource Protection: Enable implementation focus on the 17 high-confidence opportunities

The PrimeOne™ Difference: Traditional automation approaches often discover these marginal opportunities only after implementation costs are sunk. PrimeOne™'s comprehensive assessment identifies them during discovery, when organizations can still make strategic decisions about resource allocation.

FTE Impact and Capacity Gain Analysis

- Total Portfolio Capacity Gain: 15,791 hours annually

- Total Portfolio FTE Reduction: 8.64 FTEs

- Average Capacity Gain per Opportunity: 790 hours

- verage FTE Impact per Opportunity: 0.43 FTE

- Range: 0.06 to 1.75 FTE per opportunity

High-Impact Capacity Opportunities (>1,000 hours annually):

- Auto Alerts (Consumer Servicing): 3,171 hours (1.75 FTE)

- Encompass Single Sign-On (Mortgage): 2,410 hours (1.32 FTE)

- Cold Report – Accounts in Process (Deposit Operations): 2,502 hours (1.38 FTE)

- OFAC Alerts (Deposit Operations): 1,781 hours (0.98 FTE)

Capacity Redeployment Value:

The 15,791 hours of annual capacity gain represent significant strategic value beyond direct cost savings:

- Strategic Initiative Enablement: Workforce capacity freed for digital transformation, customer experience enhancement, and product innovation projects

- Workforce Upskilling: Time available for training, professional development, and skill building in emerging banking capabilities

- Complex Problem Resolution: Staff redeployment to higher-judgment activities requiring human expertise and relationship management

- Business Growth Support: Capacity to absorb volume growth without proportional headcount increases

- Regulatory Excellence: Enhanced focus on compliance, risk management, and quality assurance activities

Capacity Gain Distribution by Business Unit:

- Mortgage: 4,639 hours (29.4%) - Enables focus on complex underwriting and customer relationship management

- Deposit Services: 4,175 hours (26.4%) - Supports enhanced customer service and exception handling

- Deposit Operations: 3,751 hours (23.8%) - Allows redeployment to reconciliation and quality oversight

- Consumer Servicing: 3,171 hours (20.1%) - Enables focus on complex customer issues and retention activities

- Bankcard Services: 55 hours (0.3%) - Limited but focused capacity for fraud investigation

Strategic Value: FTE reduction and capacity gain distribution demonstrate automation's ability to free capacity across multiple roles and business units, enabling workforce redeployment to higher-value activities while maintaining operational coverage. Unlike headcount reduction, capacity gain focuses on workforce optimization and strategic redeployment.

Error Reduction and Quality Improvement

Total Annual Error Reduction: 219,765 errors eliminated

High-Impact Quality Opportunities:

- Auto Alerts: 45,000 errors

- Benefit Disbursements: 27,265 errors

- Account Type: 15,685 errors

- Posting Rejects: 14,404 errors

Strategic Insight: Beyond labor savings and capacity gain, the portfolio delivers substantial quality improvements that reduce compliance risk, enhance customer experience, and minimize error remediation costs. Each error prevented frees additional capacity that would otherwise be consumed by rework and customer issue resolution.

Cost Structure Analysis

Total Portfolio Investment: $1,429,360

Average Cost per Opportunity: $71,468

Cost Distribution:

- Under $50K: 9 opportunities (45%)

- $50K-$100K: 8 opportunities (40%)

- $100K+: 3 opportunities (15%)

Highest-Investment Opportunities:

- Auto Alerts (Consumer Servicing): $200,000

- OFAC Alerts (Deposit Operations): $145,000

- Death Certificate Review – 180 Upgrade (Deposit Operations): $105,000

Cost Avoidance Through PrimeOne™ Assessment:

- Protected Implementation Costs: ~$168,000 (3 opportunities flagged for optimization)

- Effective Portfolio Efficiency: Resources concentrated on 17 high-confidence opportunities

Cost per Hour of Capacity Gained:

- Portfolio Average: $90.50 per annual hour of capacity gained ($1,429,360 ÷ 15,791 hours)

- Top Performers: As low as $9.70 per hour (Encompass Single Sign-On)

- Strategic Benchmark: Significantly below average fully loaded hourly cost of banking personnel ($55-75/hour)

Strategic Insight: Portfolio demonstrates disciplined cost management with 85% of opportunities under $100K, enabling broader deployment while concentrating larger investments in proven high-value processes. PrimeOne™'s early identification of marginal opportunities prevented approximately $168,000 in losses that would have generated minimal or negative returns. The cost-per-hour-gained metric demonstrates compelling economics for automating capacity.

PrimeOne™ Platform Capabilities Demonstrated

Integrated Discovery and Assessment

This case study showcases PrimeOne™'s end-to-end discovery-as-a-service capabilities:

Comprehensive Opportunity Capture:

- 20 opportunities identified across five business units

- Standardized assessment framework ensuring consistent evaluation

- Complete transaction volume, processing time, and resource utilization documentation

- Detailed capacity gain analysis across all opportunities

Financial Modeling Excellence:

- Automated BCR calculations with interpretation categorization

- Three-year benefit projections with cost amortization

- Capacity gain quantification and redeployment value analysis

- Portfolio-level aggregation and rollup analytics

- Sensitivity analysis supporting investment decision confidence

Strategic Prioritization and Risk Management:

- Multi-dimensional scoring across ROI, BCR, FTE impact, capacity gain, and error reduction

- Risk flagging through "Reconsider or Optimize" classification

- Implementation timeline estimation supporting resource planning

- Portfolio balance assessment, ensuring sustainable deployment velocity

- Transparent identification of marginal opportunities protecting ~$168,000 in implementation costs

Enterprise Governance and Visibility

Centralized Automation Pipeline:

PrimeOne™ served as the single source of truth for this institution's automation program, eliminating the fragmentation and inconsistency inherent in spreadsheet-based approaches:

- Digital Intake: All 20 opportunities captured, documented, and assessed within a unified platform

- Standardized Evaluation: Consistent methodology applied across diverse processes and business units

- Transparent Prioritization: Clear BCR-based ranking enabling objective resource allocation decisions

- Risk Visibility: Explicit flagging of 3 marginal opportunities before implementation of resource commitment

- Executive Visibility: Portfolio-level dashboards providing strategic oversight and value tracking

- Capacity Planning: Comprehensive workforce impact analysis supporting strategic redeployment initiatives

The Platform Value Proposition:

PrimeOne™'s assessment created strategic value by:

- Identifying what to automate: 17 high-confidence opportunities with 135.8% average ROI and 14,435 hours of capacity gain

- Identifying what NOT to automate: 3 marginal opportunities flagged for optimization

- Protecting implementation resources: ~$168,000 in costs avoided through early risk identification

- Enabling portfolio management: Complete visibility across all 20 opportunities supporting strategic decision-making

- Quantifying capacity opportunities: 15,791 hours of annual capacity gain, enabling workforce strategic redeployment

Strategic Insights and Recommendations

Key Success Factors

1. Comprehensive Assessment Creates Value

PrimeOne™'s evaluation of all 20 opportunities, not just the obvious winners, generated strategic value by protecting implementation resources. The ~$168,000 in automation costs avoided through early identification of marginal opportunities represents immediate value creation before any automation is deployed.

Strategic Implication: Discovery platforms should illuminate risks rather than hide them. The three "Reconsider or Optimize" opportunities demonstrate that assessment value comes from knowing what NOT to automate, not just what to automate.

2. Capacity Gain as Strategic Asset

The 15,791 hours of annual capacity gain represent more than cost savings—it's strategic workforce capacity that can be redeployed to growth initiatives, customer experience enhancement, and regulatory excellence. This capacity-focused perspective shifts automation from a cost reduction tool to a strategic enabler.

Strategic Implication: Successful automation programs articulate value in terms of capacity creation for strategic priorities, not just headcount reduction. The ability to absorb growth, pursue innovation, and enhance capabilities without proportional headcount increases becomes a competitive advantage.

3. Portfolio-Based Thinking

The 81.8% portfolio ROI represents the power of diversified automation investment. Individual opportunity performance ranged from -79% to 660%, but portfolio-level returns remained strongly positive through strategic diversification and disciplined prioritization.

Strategic Implication: Rather than seeking perfect process identification, successful automation programs build balanced portfolios that accept calculated risks while maintaining overall positive returns. The recommended implementation portfolio of 17 opportunities (an average ROI of 135.8%) demonstrates how transparent prioritization enhances performance.

4. Transparent Risk Management

PrimeOne™'s explicit flagging of three "Reconsider or Optimize" opportunities demonstrates mature governance. These items, representing 15% of the pipeline, were identified before resource commitment, protecting portfolio returns and enabling focused implementation on proven opportunities.

Strategic Implication: Automation platforms should be diagnostic tools, not sales tools. Organizations need platforms that tell them uncomfortable truths about marginal opportunities, enabling strategic resource allocation decisions.

5. Multi-Dimensional Value Creation

Beyond the $1.17M net benefit, the portfolio delivers:

- 15,791 hours of annual capacity gain for strategic redeployment

- 8.64 FTEs freed for higher-value work

- 219,765 annual errors eliminated

- Improved compliance and risk management

- ~$168,000 in implementation costs protected through risk assessment

Strategic Implication: Successful business cases articulate value across multiple dimensions, resonating with diverse stakeholder priorities and building broad organizational support.

6. Disciplined Cost Management

With 85% of opportunities under $100K investment, the portfolio demonstrates accessible automation economics. This cost structure enables broader deployment while concentrating larger investments in validated high-return processes.

Strategic Implication: Automation programs should optimize for volume of successful implementations, not just the magnitude of individual returns. Sustainable programs build momentum through consistent wins.

Strategic Recommendations for Banking Leaders

Immediate Actions:

- Implement Discovery-as-a-Service: Adopt enterprise-grade assessment platforms like PrimeOne™ to replace fragmented opportunity identification and gain transparent risk visibility.

- Build the Comprehensive Pipeline: Conduct full-spectrum process discovery across business units, including marginal opportunities, to enable strategic portfolio management.

- Quantify Capacity Opportunities: Assess automation value in terms of workforce capacity gained for strategic redeployment, not just cost reduction.

- Establish Governance Standards: Define minimum BCR thresholds, ROI expectations, and portfolio balance criteria, using transparent assessment to enforce standards.

- Create Cross-Functional Ownership: Establish business-IT partnership models that align automation initiatives with strategic priorities.

Medium-Term Strategic Initiatives:

- Develop Implementation Capacity: Build an internal automation CoE or establish strategic partner relationships to execute the recommended opportunity portfolio.

- Plan Capacity Redeployment: Develop strategic workforce plans for the 15,791+ hours of capacity gained through automation

- Institutionalize Metrics: Implement closed-loop tracking from assessment through realization to continuously refine opportunity identification

- Scale Strategically: Use portfolio analytics to guide resource allocation, balancing quick wins with transformational opportunities

- Communicate Value Transparently: Develop executive dashboards that show both opportunities recommended and opportunities protected through risk assessment.

Long-Term Transformation:

- Automation-Native Operations: : Design future state operations around automation capabilities rather than traditional workforce models

- Strategic Capacity Management: Position automation as a capacity creation tool enabling growth without proportional headcount increases

- Continuous Discovery: Establish perpetual opportunity identification as a core organizational competency

- Ecosystem Automation: Extend automation beyond internal processes to partner and customer touchpoints

- Platform Modernization: Leverage automation insights to guide strategic technology investment and architecture evolution

- Risk-Aware Portfolio Management: Build organizational capability to manage automation portfolios with transparent risk assessment

Industry Implications and Competitive Positioning

Banking Automation Evolution

The results demonstrated in this case study represent a fundamental shift in banking automation from tactical efficiency improvements to strategic transformation enablement. Financial institutions that adopt portfolio-based automation approaches using enterprise-grade discovery platforms like PrimeOne™ position themselves for sustained competitive advantage.

Industry Transformation Indicators:

- Movement from ad-hoc process automation to strategic portfolio management

- Integration of discovery capabilities with risk assessment and prioritization

- Shift from headcount reduction to strategic capacity creation

- Development of automation-native operational models

- Emergence of automation assessment as a core competency rather than a project-level activity

- Recognition that knowing what NOT to automate is as valuable as knowing what to automate

Democratization of Automation Success

This mid-sized institution's 81.8% portfolio ROI demonstrates that transformational automation results are accessible beyond the largest banking organizations. While major institutions like JPMorgan Chase and Bank of America deploy billions in AI and automation investments, mid-sized banks can achieve compelling returns through disciplined, discovery-driven approaches

Key Differentiators:

- Strategic Assessment vs. Technology Deployment: Success stems from rigorous opportunity identification and risk management, not just implementation capability

- Portfolio Economics vs. Individual Project ROI: Diversified automation portfolios with transparent risk assessment deliver sustained returns while managing implementation risk

- Capacity Creation vs. Cost Reduction: Positioning automation as a strategic capacity enabler rather than purely a cost reduction initiative

- Discovery-as-a-Service vs. Manual Analysis: Enterprise platforms like PrimeOne™ enable assessment sophistication previously available only to the largest institutions

- Risk Visibility vs. Optimistic Projections: Transparent identification of marginal opportunities builds stakeholder confidence and protects implementation resources

Competitive Advantage Through Discovery Excellence

The case study reveals that automation's competitive advantage stems from the discovery and assessment phase, not just from execution excellence. Organizations that invest in robust discovery capabilities identify opportunities competitors miss and avoid implementations that destroy value.

PrimeOne™'s Strategic Value:

- Early-Stage Value Creation: ROI differentiation begins with opportunity identification and risk assessment, not just development efficiency

- Risk Mitigation: Transparent assessment flags marginal opportunities before resource commitment—this case study protected ~$168,000

- Capacity Intelligence: Comprehensive workforce impact analysis enables strategic capacity planning and redeployment

- Portfolio Intelligence: Aggregated analytics inform strategic resource allocation and program scaling decisions

- Sustainable Scaling: Standardized assessment with explicit risk management enables automation programs to grow beyond pilot phases

- Stakeholder Confidence: Transparent methodology that identifies both opportunities and risks builds organizational trust

Conclusion: The Path Forward

The banking automation initiative analyzed in this white paper demonstrates that strategic process automation, powered by PrimeOne™'s discovery-as-a-service capabilities, can deliver compelling returns when approached with rigorous assessment methodology, transparent risk management, and portfolio-based thinking. The 81.8% portfolio ROI, generated from a balanced portfolio of 20 opportunities spanning five business units, with 17 recommended for implementation and three flagged for optimization, represents sustainable automation economics accessible to mid-sized financial institutions.

The initiative also demonstrates the strategic value of capacity creation, with 15,791 hours of annual capacity gain enabling workforce redeployment to higher-value strategic initiatives, customer experience enhancement, and regulatory excellence, transforming automation from a cost-reduction tool into a strategic enabler.

Success in banking automation requires three critical elements: comprehensive upfront discovery, transparent risk-based prioritization, and portfolio-level strategic management with a focus on capacity creation. PrimeOne™ provides the integrated assessment platform that enables banks to identify, evaluate, and prioritize automation opportunities with unprecedented precision and strategic insight, all within a single, unified environment.

The case study reveals several fundamental truths about banking automation success:

1. Comprehensive Assessment Creates Value Before Implementationd

PrimeOne™'s evaluation of all 20 opportunities—including explicit identification of 3 marginal candidates—protected approximately $168,000 in implementation costs that would have generated minimal or negative returns. This represents immediate value creation through risk avoidance, before any automation is deployed.

2. Capacity Gain Is Strategic Value

The 15,791 hours of annual capacity gain represent more than cost savings—it's strategic workforce capacity available for growth initiatives, innovation, customer experience enhancement, and regulatory excellence. This shifts the automation value proposition from "doing the same with less" to "doing more with the same"—enabling competitive advantage through enhanced capabilities.

3. Portfolio Beats Perfection

An average return of 81.8% across 20 diverse opportunities, with a recommended implementation set of 17 (135.8% average ROI), outperforms pursuing only "perfect" automations. Strategic portfolios accept calculated risks while maintaining positive overall returns through disciplined prioritization.

4. Transparency Enables Scaling

Explicit identification of marginal opportunities (the 15% "Reconsider or Optimize" category) builds stakeholder confidence and supports program growth. Organizations trust platforms that tell them what NOT to do, not just what to do.

5. Risk Management Is a Strategic Value

The three flagged opportunities serve multiple purposes beyond cost avoidance: they establish portfolio governance standards, inform automation design principles, and demonstrate analytical rigor. This transparency differentiates PrimeOne™ from tools that only show optimistic projections.

6. Discipline Drives Returns

Standardized assessment methodology, consistent financial modeling, objective prioritization, and explicit risk flagging separate successful automation programs from failed pilots. The 28.3 percentage point ROI improvement (107.5% full pipeline vs. 135.8% recommended portfolio) demonstrates the value of disciplined prioritization.

7. Integration Accelerates Time-to-Value

Conducting the entire discovery process within PrimeOne™—from opportunity capture through financial modeling, capacity analysis, and risk assessment—enabled rapid evaluation of 20 opportunities with consistent, auditable methodology and immediate identification of implementation priorities.

Financial institutions that embrace PrimeOne™'s discovery-as-a-service approach will find themselves well-positioned for the next phase of industry evolution, where automated assessment capabilities and transparent risk management become fundamental differentiators for identifying value opportunities while avoiding value-destroying implementations.

The question for banking leaders is not whether to pursue process automation, but how quickly they can develop the strategic discovery, assessment, and risk management frameworks necessary to build balanced automation portfolios that deliver sustained competitive advantage while creating strategic workforce capacity.

This case study demonstrates that with the right platform, methodology, and transparent risk management approach, mid-sized banking institutions can achieve automation economics that drive meaningful strategic advantage—turning process automation from a tactical efficiency tool into a sustained competitive differentiator, while simultaneously creating strategic workforce capacity for growth and innovation.

This white paper is based on a comprehensive banking automation assessment conducted using PrimeOne™'s discovery-as-a-service platform. Results represent actual opportunity assessment and projected returns based on rigorous financial modeling and process evaluation methodologies validated against industry benchmarks. All discovery, analysis, prioritization, risk assessment, and portfolio management activities were conducted within PrimeOne™'s integrated platform. The assessment demonstrates PrimeOne™'s strategic value in both identifying high-return automation opportunities and protecting implementation resources through transparent risk management.

Share this

Dr. Danielle Jennings

Primus Practice Director, Intelligent Automation

Dr. Danielle Jennings serves as the Client Services Executive and Automation Practice Lead at Primus Software Corporation. In this dynamic role, she spearheads client engagement initiatives while contributing to the division’s growth and success. With 15 years of experience in IT, including 7 years specializing in intelligent automation, Dr. Jennings has been instrumental in implementing transformative technologies such as RPA, chatbots, AI, and ML in mid-size to Fortune 500 companies.